Taxpayers often choose to deconstruct homes or corporate buildings with hopes of taking an income tax deduction for charitable contributions. Like all things tax-related, the potential for abuse is high.

How does this work?

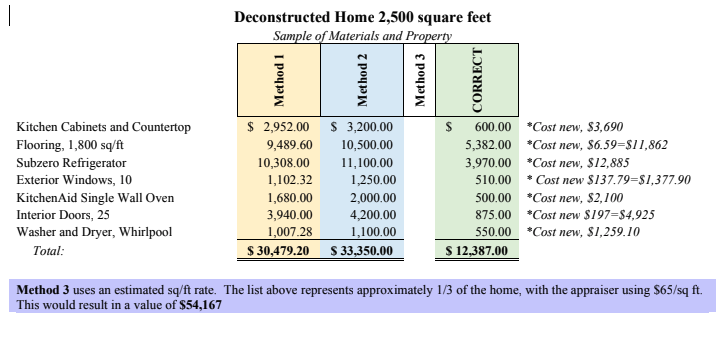

Homeowner A chooses to deconstruct their home. A contract is signed with Deconstruction Contractor B to dismantle the structure and donate the salvaged materials to Nonprofit C. A hires Appraiser D to value the materials. D inspects the property, creates a list of materials and begins the appraisal valuation. D incorrectly values the materials and property using one of three prevalent methods, none of which align with appraisal standards, IRS code or accounting standards and results in inflated valuations

- 1Takes the value of the brand new material and deducts depreciation from this value.

- 2Plugs the material into new construction pricing software and then applies any depreciation rate to arrive at the desired value (note, this software is not meant to value used materials), or

- 3Determines a square footage value for the home and applies it across the board as donation value.

The correct method is to research comparable sales data from the market to arrive at a valuation for each material. The Cost Approach can be used only in rare cases where a very valuable material or property does not have comparable sales data available, i.e., custom made furnishings or built-in features.

The example below, calculates valuations for a 2,500 square foot home using Methods 1-3 above as well as the correct method. Please note Method 3 is presented in total at the bottom. Method 1 uses a 10-year life with 2 years depreciation taken. Method 2 demonstrates haphazard depreciation rates applied within construction estimating software to reach desired values. The correct method, uses completed sales data.